Lachlan and Rupert Murdoch have been praised for their guidance in News Corp's full-year results, which boasted a two per cent lift in revenue to $US8.5 billion ($A13.1 billion), despite fading news media income.

Subscribe now for unlimited access.

or signup to continue reading

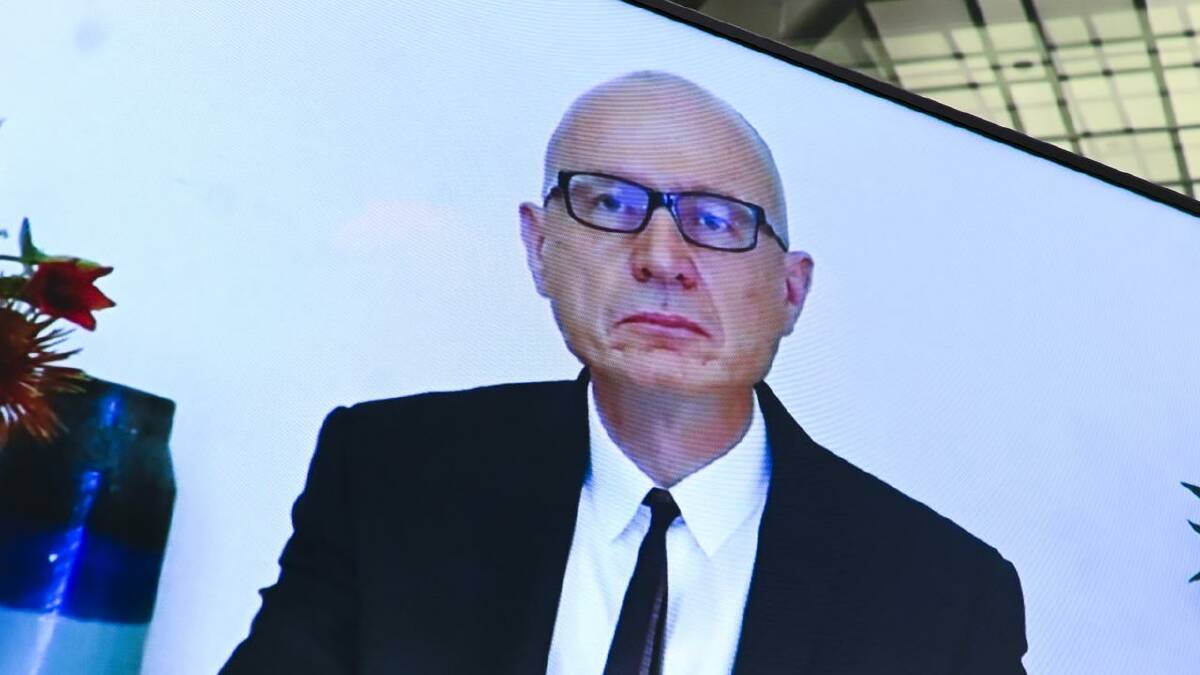

See subscription optionsIn an upbeat address to an earnings call, chief executive Robert Thomson hailed the organisation's digital expansion, supported by growth in its Dow Jones segment, which includes the Wall Street Journal and REA Group, which owns realestate.com.au.

"To conclude the fiscal year with such impressive results against a backdrop of complex macro conditions and clinical dynamics is a testament to our transformation," Mr Thomson said.

"That work simply would not be possible without the astute leadership of Lachlan Murdoch, the support of an enlightened board and the enduring residence of our chairman emeritus, Rupert Murdoch."

The CEO also railed against the threat of artificial intelligence to intellectual property rights, and said the United State's comparative advantage to China in the AI race was its "ingenuity and creativity".

"To undermine that comparative advantage by stripping away IP rights is to vandalise our virtuosity," Mr Thomson said.

"We need to be more enlightened to eulogise eunoia socially and commercially."

The chief used US President Donald Trump's The Art of the Deal as a chief example of such precious intellectual property.

"Is it right that his books should be consumed by an AI engine which then profits from his thoughts by cannibalising content, thus undermining future sales?"

"The art of the deal has become the art of the steal."

Returning to the results, net income from continuing operations grew 71 per cent to $US648 million ($A1 billion), up from $US379 million ($A585 million) the previous year with Dow Jones and REA posting record revenues of $US2.3 billion ($A3.6 billion) and $US1.3 billion ($A2 billion) respectively.

Book publishing revenue, supported by a Spotify partnership for audiobooks, grew 3.1 per cent to $US2.2 billion ($A3.4 billion).

"Fiscal 2025 marked a big step in the transformation of News Corp, as we continue to expand into high-margin content licensing and increase recurrent and digital revenues," chief financial officer Lavanya Chandrashekar said.

But the organisations traditional income streams were less healthy, as news media revenues from both advertising and subscriptions continued to fade, slipping four per cent to $US2.1 billion ($A3.2 billion).

News Corp Australia's closing digital subscribers fell by roughly 50,000 over the financial year, while the New York Post's subscriber pool slumped to 90 million from 117 million the year before, while digital subscriptions for UK tabloid The Sun sank to 87 million from 112 million globally.

The Times and Sunday Times bucked the trend, growing their subscriber base from 594,000 to 640,000 over the year.

Profitability in the sector improved 15 per cent, which Mr Thomson attributed to the group's "editorial creativity" and cost consciousness, which included significant layoffs across brands in Australia, the US and UK.

Australian Associated Press